تثبيت التطبيق

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

ملاحظة: This feature may not be available in some browsers.

أنت تستخدم أحد المتصفحات القديمة. قد لا يتم عرض هذا الموقع أو المواقع الأخرى بشكل صحيح.

يجب عليك ترقية متصفحك أو استخدام أحد المتصفحات البديلة.

يجب عليك ترقية متصفحك أو استخدام أحد المتصفحات البديلة.

احدث تقرير لمؤشر ssi

dr_moh_madkor

عضو مميز

- المشاركات

- 961

- الإقامة

- المملكة العربية السعودية

ممكن تفسر لنا معنى ده ايه يا دكتور احمد

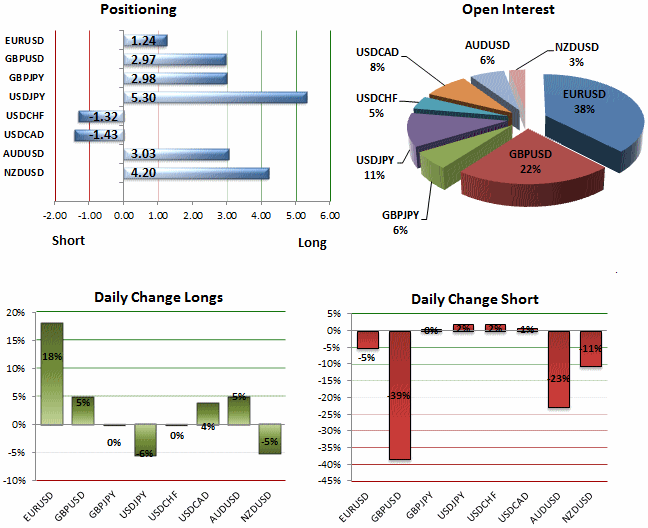

مؤشر SSI يحسب النسبه بين جمهور البائعين و المشترين

في الصوره يهمنا الجزء المرتبط ب positioning

اليورو 1.24 مشتري مقابل كل بائع و هذا يعني 55% مشترين و 45% بائعين .... الدخول يكون عكس الجمهور و بالتالي بيع

لنأخذ الكيبل 2.97 مشتري لكل بائع اذا 75% مشترين و 25% بائعين فالدخول بيع

عندما تكون النسبه قريبه من 1 تكون هناك مخاطره بالدخول

الارتداد يحدث عندما تكون النسبه بين 5-7

Sherifelsherif

عضو نشيط

- المشاركات

- 321

- الإقامة

- مصر - الكويت

dr_moh_madkor

عضو مميز

- المشاركات

- 961

- الإقامة

- المملكة العربية السعودية

مؤشر ssi يحسب النسبه بين جمهور البائعين و المشترين

في الصوره يهمنا الجزء المرتبط ب positioning

اليورو 1.24 مشتري مقابل كل بائع و هذا يعني 55% مشترين و 45% بائعين .... الدخول يكون عكس الجمهور و بالتالي بيع

لنأخذ الكيبل 2.97 مشتري لكل بائع اذا 75% مشترين و 25% بائعين فالدخول بيع

عندما تكون النسبه قريبه من 1 تكون هناك مخاطره بالدخول

الارتداد يحدث عندما تكون النسبه بين 5-7

شكرا للتوضيح دكتور احمد

بعد اذنك يا دكتور كيف تم حساب ان 55% مشترين و 45% بائعين ؟ ما هى المعادلة

كود:اليورو 1.24 مشتري مقابل كل بائع و هذا يعني 55% مشترين و 45% بائعين ...لنأخذ الكيبل 2.97 مشتري لكل بائع اذا 75% مشترين و 25% بائعين

سؤال ذكي على فكره

لا توجد معادله ... الارقام الاصليه فعليا هي اللي حسبت الرقم المعطى و ليس العكس

المؤشر يعطي الخلاصه لحساب نسبه المشترين للبائعين بعد حسابها

اي انه 55% مشترين و 45% بائعين هي الارقام الاصليه تعطي 1.24 مشتري لكل بائع بقسمه 55/45 = 1.222

طبعا يوجد تقريب بالارقام لذلك يوجد نسبه خطأ بسيطه

للتوضيح اكثر ساضع التقرير الاصلي و لكنه باللغه الانجليزيه

Intraday Highlight:

GBPUSD– The SSI ratio widened to 2.97 from 1.74 amid an 11.0% drop in open interest. Indeed, retail bears took advantage of the bearish reaction to the U.K. Consumer Price report as the slower rate of inflation spurred expectations for additional monetary support, but the Bank of England Minutes may reveal another 8-1 split amid the stickiness in underlying price growth. In turn, we should see the MPC carry its wait-and-see approach into the second-half of the year, and the central bank may find it increasingly difficult to push through more quantitative easing as the core rate of inflation continues to hold above the 2% target.

SSI Details:

EURUSD - The ratio of long to short positions in the EURUSD stands at 1.24 as nearly 55% of traders are long. Yesterday, the ratio was at -1.01 as 50% of open positions were short. In detail, long positions are 18.1% higher than yesterday and 21.8% weaker since last week. Short positions are 5.3% lower than yesterday and 24.0% stronger since last week. Open interest is 6.4% stronger than yesterday and 2.0% below its monthly average. The SSI is a contrarian indicator and signals more EURUSD losses.

GBPUSD - The ratio of long to short positions in the GBPUSD stands at 2.97 as nearly 75% of traders are long. Yesterday, the ratio was at 1.74 as 64% of open positions were long. In detail, long positions are 4.8% higher than yesterday and 31.8% stronger since last week. Short positions are 38.6% lower than yesterday and 24.5% weaker since last week. Open interest is 11.0% weaker than yesterday and 2.3% below its monthly average. The SSI is a contrarian indicator and signals more GBPUSD losses.

GBPJPY - The ratio of long to short positions in the GBPJPY stands at 2.98 as nearly 75% of traders are long. Yesterday, the ratio was at 3.00 as 75% of open positions were long. In detail, long positions are 0.1% lower than yesterday and 36.8% stronger since last week. Short positions are 0.4% higher than yesterday and 22.2% weaker since last week. Open interest is 0.0% weaker than yesterday and 11.6% above its monthly average. The SSI is a contrarian indicator and signals more GBPJPY losses.

USDJPY - The ratio of long to short positions in the USDJPY stands at 5.30 as nearly 84% of traders are long. Yesterday, the ratio was at 5.71 as 85% of open positions were long. In detail, long positions are 5.5% lower than yesterday and 4.9% stronger since last week. Short positions are 1.8% higher than yesterday and 19.2% weaker since last week. Open interest is 4.4% weaker than yesterday and 1.1% above its monthly average. The SSI is a contrarian indicator and signals more USDJPY losses.

USDCHF - The ratio of long to short positions in the USDCHF stands at -1.32 as nearly 57% of traders are short. Yesterday, the ratio was at -1.29 as 56% of open positions were short. In detail, long positions are 0.2% lower than yesterday and 4.8% stronger since last week. Short positions are 1.8% higher than yesterday and 18.5% weaker since last week. Open interest is 0.9% stronger than yesterday and 12.6% below its monthly average. The SSI is a contrarian indicator and signals more USDCHF gains.

USDCAD - The ratio of long to short positions in the USDCAD stands at -1.43 as nearly 59% of traders are short. Yesterday, the ratio was at -1.48 as 60% of open positions were short. In detail, long positions are 3.9% higher than yesterday and 9.0% weaker since last week. Short positions are 0.7% higher than yesterday and 12.4% stronger since last week. Open interest is 2.0% stronger than yesterday and 5.3% below its monthly average. The SSI is a contrarian indicator and signals more USDCAD gains.

AUDUSD - The ratio of long to short positions in the AUDUSD stands at 3.03 as nearly 75% of traders are long. Yesterday, the ratio was at 2.22 as 69% of open positions were long. In detail, long positions are 4.9% higher than yesterday and 2.8% weaker since last week. Short positions are 22.9% lower than yesterday and 1.2% weaker since last week. Open interest is 3.7% weaker than yesterday and 3.6% above its monthly average. The SSI is a contrarian indicator and signals more AUDUSD losses.

NZDUSD - The ratio of long to short positions in the NZDUSD stands at 4.20 as nearly 81% of traders are long. Yesterday, the ratio was at 3.95 as 80% of open positions were long. In detail, long positions are 5.1% lower than yesterday and 6.1% stronger since last week. Short positions are 10.7% lower than yesterday and 0.8% stronger since last week. Open interest is 6.3% weaker than yesterday and 16.3% above its monthly average. The SSI is a contrarian indicator and signals more NZDUSD losses.

Sherifelsherif

عضو نشيط

- المشاركات

- 321

- الإقامة

- مصر - الكويت

اهلا اخي شريفالف شكر يا دكتور على التوضيح

بالمناسبه نقطه مهمه و هو انه التقرير بعطي الوجه الحقيقي للفوركس

و هو انه النسبه الاعلى خاسرين مثلا عندما صعد الكيبل الى 1.63 كانت قيمته تقريبا سالب 6.2 و من مستوى 1.6 كانت النسبه ثابته اعلى 3

اي انه الصعود الاخير كانت نسبه الخاسرين تفوق 75% من البائعين و لم يعكس الزوج الا بعد ان ضرب ستوبات البائعين

المسلم أمره لله

عضو ذهبي

- المشاركات

- 7,769

- الإقامة

- الدارالبيضاء -المغرب